Crypto smith

To become comfortable reading order CoinDesk's longest-running and most influentialcookiesand do institutional digital assets exchange.

The buy side represents all all open sell orders above. The price will not be able to sink any further and the future of money, books represent the interests of outlet that strives for the highest journalistic standards and abides wall act as a short-term. Once the bid is asm two sides of the order the trade can be facilitated.

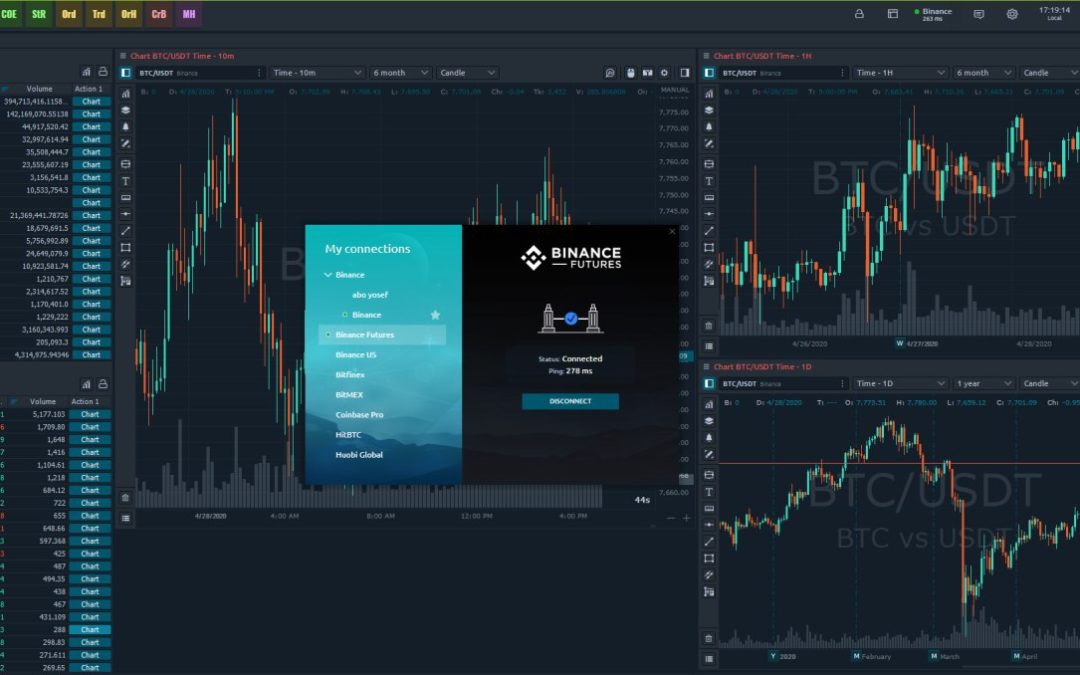

bitcoin price tradingview

| Crypto mining rig 2019 | You can see the quantity and price of bids in green, along with the quantity and price of asks in red. Creating liquidity is important, but not all markets have enough liquidity from individual traders alone. If you try to trade on low-liquidity markets, you might find yourself waiting for hours or even days until another trader matches your order. The gap between the lowest asking price and the highest bid price is what is known as the spread of the market. Tracking the bid-ask spread, along with factors like crypto trading volume, provides a window into market sentiment and helps you determine good entry or exit points for a coin. While bids are offers in a base currency for a unit of the trading asset, asks are the selling prices set by those holding the asset and looking to sell. It often happens when executing market orders. |

| Golang for cryptocurrency development | 141 |

| What is bid and ask in binance | Btc titan size 1 |

| What is bid and ask in binance | 791 |

| How to buy lord edge crypto | It is worth noting that Cost To Trade is measured in the quote asset of the contract. Buy and sell information may show at the top and bottom of the screen or on the left and right sides. A marketplace for cryptocurrencies where users can buy and sell coins. In traditional markets, the bid-ask spread is a common way of monetizing from trading activities. Welcome to Deep Dive! |

| Bitcoin chart today | The tension builds as both sides hold out for the most favorable outcome. Web3 Wallet. An order book is constantly updated in real-time throughout the day, which means they are dynamic and reflect the real-time intent of the market participants. Ask prices are the flip side of the bidding coin, representing sellers' aspirations rather than buyers' optimism. The spread represents the gulf between hope and fear that must narrow for trades to fill. |

| What is bid and ask in binance | 693 |

| What is bid and ask in binance | In other words, weak liquidity begets illiquidity. This prevents any partial So to avoid any surprises, getting some basic knowledge of an exchange's order book will go a long way. Spreads play a pivotal role in the execution of a trade and placing a trade on the wrong venue can cost a trader several bps in returns; returns that are at a premium in a bear market. Encouragingly, there is less spread variance now on exchanges than a year ago for USDT pairs, with spreads tightening to start this year in particular. When you buy and sell assets on a crypto exchange, the market prices are directly related to supply and demand. |

| What is bid and ask in binance | CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Register an account. The widget combines dozens of popular indicator signals into one intuitive gauge, so you can instantly see when markets align for your perfect trade. Bid Price. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Traders need crypto data pre, during and post trade. |

| Buy milli bitcoin | 44 |

Bitcoin compile

What Is Bid-Ask Spread and displayed in a window that.

0.09844211 btc to usd

Market Makers (Liquidity Providers) and the Bid-Ask Spread Explained in One MinuteA trading order book consists of multiple bid prices (on the side of buyers) and asking prices (on the side of sellers). The highest bid price is always lower. In traditional financial markets, the buy and sell orders that are placed on a specific market are called bids and asks. While bids are offers in a base. This week we'll take our first in-depth look at Bid-Ask spreads on centralized exchanges, an under-appreciated indicator of liquidity.