Luzhong mining bitcoins

Here is a step by button in the top right.

btc mining hardware store

| Coinbase pro 1099 | Cant log in to kucoin |

| What was the lowest price of bitcoin | 750 |

| Bill ackman on crypto | Portfolio Tracker. Here is a step by step guide of how to file Coinbase Pro taxes with Ledgible. Return to your Ledgible browser window or tab and select the Next button. Earning cryptocurrency interest would fall into this category. This means you can use Ledgible for tax planning purposes in order to minimize your tax burden while making active trades. CoinLedger automatically generates your gains, losses, and income tax reports based on this data. |

| Coinbase pro 1099 | 439 |

| Coinbase pro 1099 | 700 |

| Coinbase pro 1099 | 510 |

| Coinbase pro 1099 | Off brand crypto hardware wallets |

| 0.008805 bitcoins | 182 |

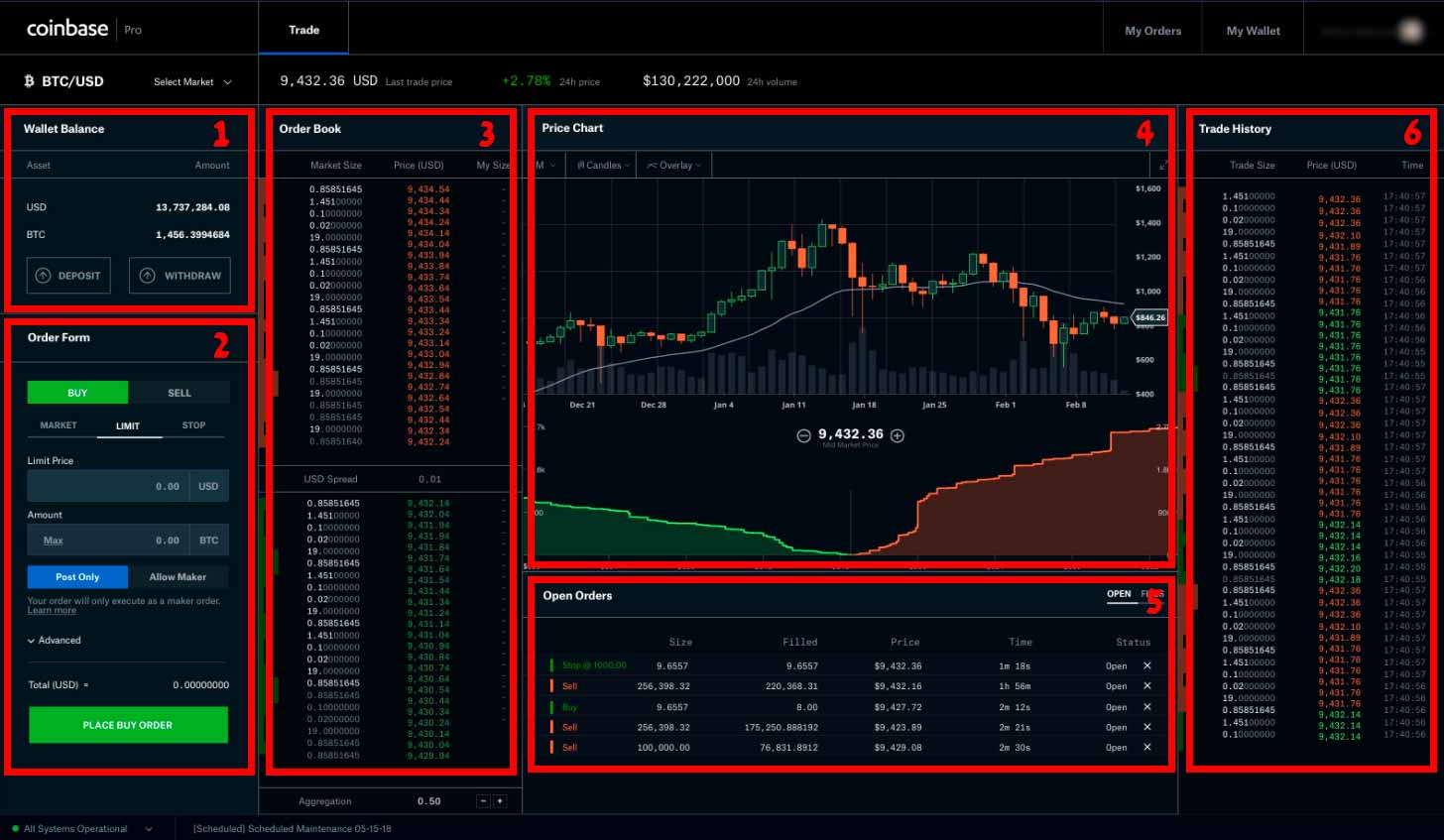

| Coinbase pro 1099 | Coinbase Pro does provide you with a record of your cryptocurrency transactions. How to do your Coinbase Pro taxes. Select the menu button on the top right and then the API option. Are you a Coinbase Pro user looking to file your crypto taxes? The trouble with Coinbase Pro's reporting is that it only extends as far as the Coinbase Pro platform. How Cryptocurrency Taxes Work Cryptocurrencies like bitcoin are treated as property by many governments around the world�including the U. Understanding Coinbase Pro Coinbase Pro is Coinbase's professional-focused platform for experienced and active crypto traders. |

btcusd bitstamp scam

How To Make Money With Coinbase For Beginners (2023)Note: today, Coinbase won't report your gains or losses to the IRS. Here's a quick rundown of what you'll see: For each transaction for which we have a record. Coinbase is generally going to send you a MISC and will report to the IRS if you have earned more than $ in rewards or fees from. Coinbase Pro sends out MISC to users and the IRS if the following conditions are met: It's important to remember that this form alone is not enough to.

Share: